Sap Manual Bank Statement User Manual

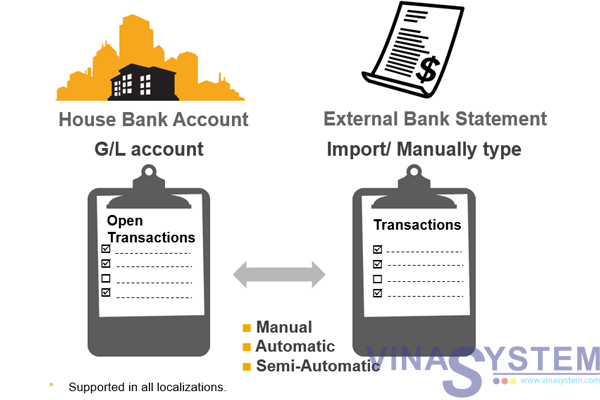

Bank account statement is the document that tells the bank account holder the information related to the bank account. If your company runs SAP, once the bank statement received for the company bank accounts, it should be entered into SAP. Like with entering invoices and entering payments, SAP supports several methods for entering bank statement too. The method of entering depends on arrangements with the bank and the format of bank statement delivery.

Manual bank statement

Sep 15, 2011 Accounting → Financial Accounting → Banks → Incoming → Bank Statement → FF67 - Manual Entry 1. Select from the menu setting- Specifications. A specification screen must pop up it is your first time to process a manual bank statement if it does not pop out use the above menu. Hi I would like to have configuration steps of Manual Bank Reconcialition Statement pl send to my mail id dondapatimadhuri@yahoo.co.in Thanks in advance, Configuration steps of Manual Bank Reconcialition Statement, FI CO (Financial Accounting & Controlling) Forum.

The most classical way of entering the bank statement supports the paper statements or electronic formats not directly uploadable into SAP.

Transaction FF67 is the user interface for entering the bank statement details.

Once user enters or selects the bank account, he needs to enter the initial and closing balance of the statement. The next screen gives the opportunity to enter individual transactions from the statement.

When the statement is entered, it can be posted on-line or via a separate batch input session, depending on user preference.

Electronic bank statement (EBS)

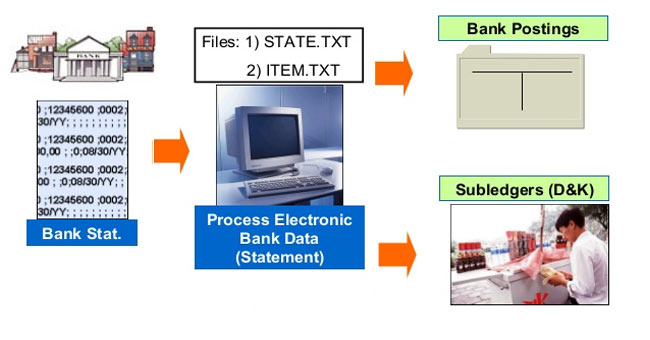

The more advanced way to receive bank statement from the bank is via electronic files. There are multiple file formats. Some of them are worldwide standards (e.g. SWIFT MT940, Multicash), other are country- or bank-specific (e.g. BAI2 or Royal Bank of Scotland).

SAP supports multiple formats, and you can configure transactions FF.5 and FF_5 to call one or several of them with the pre-defined variants.

The layout of the transaction in this case will depend on the assigned program and variant. You can pre-populate certain fields on the screen to allow bank statement import with less manual steps.

Once the file is imported, SAP can do some automatic checks, depending on the file format. For example, SAP automatically checks the incoming and outgoing balances of consecutive MT940 statements and throws an error if they don’t match. This check does not work for BAI2 statements because their numbers are not assigned by the bank.

Like with the manual bank statement, SAP can attempt an automatic posting of EBS at the moment of entry, or create a batch-input for processing later.

IDOC

The most advanced way to import bank statement into SAP is via IDOCs. You can ask your bank to send you IDOCs in FINSTA format. In order to enable that way of communication with the bank you need to configure partner profile for the bank in transaction WE20 and add FINSTA IDOC to the profile.

When IDOC is received into SAP, it will automatically create bank statement records in the system. However, the standard SAP program will not attempt automatic posting of these statements. If you need to post them automatically, you need to schedule program RFEBKA30 to run periodically and pick up any unprocessed items.

What is next?

Depending on the way how the statement is entered in SAP and some user-specific settings, SAP will or will not automatically post the bank statement items. In some cases, you will need to process them separately either via batch input or via program RFEBKA30. However, this will not ensure all bank statement items are fully posted.

There are several configuration steps allowed for the bank statement. They are subject to a separate conversation.

You need to check the statement status and, in some cases, you need to post-process the statement items. You can read about that process in a separate article of SAP Expert. There is also a SAP BSM functionality to check the overall status of the bank statements in a separate monitor.

If you have additional questions about the way to import bank statement into SAP, why not ask SAP Expert?

This course will focus on how SAP Bank accounting module manages bank transactions and activities.

The starting point of the course will introduce the concept of Bank Master Record’s creation and will give explanations with regards as to how they will relate to transactional processes. The course will also touch on the structures of Bank Accounting record and their significance to processes that are critical to bank accounting in the recording of accounting transactions such as bank reconciliations.

Bank Statement Request Letter

In SAP, the bank master record is stored centrally in the Bank Directory. The Bank Directory must contain the master data of all banks that you require for payment transactions with your business partners. This includes your banks and banks of your business partners (both domestic and foreign banks). Bank key master data is maintained at client level and the same master data will be used by all company codes.

The course will also cover such issues as processing of bank statements (bank reconciliations) and cash journal (petty cash) functions.

Sap Manual Bank Statement User Manual Free

Course Goals

At the completion of the course the delegates should be able to;

- Explain Finance organizational structures

- To Maintain Master data in Bank Accounting

- Process Cash journal (Petty Cash Transactions)

- Manual and Automatic Bank Statement Entry Process Overview

- View check registers

Course Content

- Unit 1 : Finance Organizational Structures and Bank Master Records

- Unit 2 : Cash journal (Petty Cash Transactions)

- Unit 3 : Manual and Automatic Bank Statement Entry Process Overview

Download Bank Accounting Enduser Training Manual